How to Set the Pastor’s Salary and Benefits

Today, we’re going to dissect the issue of a pastor’s salary and benefits; how to set it and establish the best possible compensation for the pastor.

I can tell you one thing for sure; it is almost universal that this is an uncomfortable subject for pastors. It shouldn’t be, but it is.

In this post we’ll look at the following:

Pastoral Compensation

Housing Allowance

Benefits

A pastor is called of the Lord to ministry, certainly not a high-paying profession. Some pastors view it as carnal to talk about money. Yet, they have bills to pay just like everyone else.

So as we go through this material, if you’re a board member, I encourage you to be thoughtful and diligent in what you can do to take care of the temporal needs of your pastor.

Here are some other helpful blogs you might find of interest for the pastor and church board member:

Church Government: Democracy or Theocracy

How Self-Policing Can Help a Negative Church Board Member Become Positive

Church Board Members Disagreeing without Drawing Blood

10 Steps to Navigating Change with Your Church Board

How to Equip Church Board Members

Top 3 Responsibilities of Every Church Board

The 5 Investments a Church Board Needs to Make in Their Pastor

7 Essential Purposes of the Church Board

Why Invest in the Church Board?

Ready to go?

Pastoral Compensation

The very first thing a church board needs to do is come to an understanding of pastoral compensation. This is a primary role of the church board to take care of the compensation of the pastor.

A starting point for any church board in the area of compensation is to talk about and cultivate a spirit of generosity. This comes naturally for some boards. But for others, it’s a stretch to get to the level of generosity they need to be.

Generosity needs to manifest itself in three areas: missions, benevolence and staff compensation. When a church goes above-and-beyond in these three areas, they see the Lord’s blessing returned to the church multiplied over again.

If the church is a cheapskate in supporting missionaries, it can forget about manifold blessings from the Lord for it to do week-in and week-out ministry. Further, when a church cannot follow the admonition to care for the poor and downtrodden, it cannot expect the Lord to come through for it when it is doing other ministry.

And when it comes to paying the pastor, I don’t hear this often, but sometime a church board can fall prey to the “let’s keep the pastor poor” mentality. It’s very rare that I hear this, but it sadly is still out there today.

Let me be clear. It is NOT the role of the church board to keep the pastor poor. Any board that does that is charting the course for the church to decline, plain and simple. Growing churches are led by pastors and church boards that are generous beyond measure.

Another thing, I’ll sometimes hear from church boards relative to compensation is the question, “What’s average?” when thinking of how to pay the pastor. When I hear that I typically respond with questions of my own, “Do you have an average pastor?” or “Do you want an average pastor?” The answers to those questions are always, “No!” Board members acknowledge their pastor is above average and that is certainly what they want in their pastor.

At that point, I ask why the church board would want to pay their pastor average if the pastor is above average. Normally, that turns a lightbulb on in their minds.

(NOTE: Want to know the proper roles and responsibilities for Church Boards? Click here)

Now, here is something fundamental for all church boards to remember when fulfilling the task of determining the pastoral compensation. Don’t make the pastor have to ask for a raise!

While the church hopefully did give the pastor a raise last year, that was then, this is now.

Board members need to put the “annual time to review the pastor’s compensation” on their personal calendars and have the church secretary or board secretary put it on the church calendar.

Certainly, if it’s possible for the church board to work with the pastor in building a church board calendar, then certainly do so. I suggest putting in the minutes that the pastor and the board are to put this issue automatically on the board agenda in the month where you prepare compensation or the month before.

For lots of churches this would be in November, prior to the start of the new calendar year. In this way, the pastor knows, everybody knows, that it automatically goes on the agenda to review the pastor’s compensation.

The pastor knows they are not putting it on the agenda to be self-serving, rather they are abiding by the wishes of the board in putting it on the agenda. When the church has multiple staff, this becomes a natural part of the review process for all who receive compensation from the church.

It’s the definition of awkward if your pastor has to remind you to give them a raise. Board member pay attention to this issue.

Now…

On the nuts and bolts of how much to pay the pastor, I recommend compensation for pastor move to the 75-percentile level of compensation of all lead pastors. Let me describe how this works.

If you’re not a math person, the 75-percentile would mean that 75% of pastors are paid less than the 75-percentile point and that 25% of pastors are paid more than the 75-percentile.

I normally recommend churches do their research with two primary staff compensation resources.

Ministry Pay

- Ministry Pay is a web-based site that allows the board to put in the specific demographics related to the church such as church size, budget, area of the country, etc. Their website is: https://ministrypay.com/

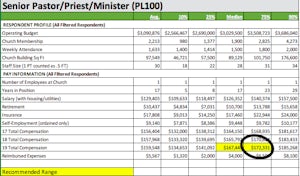

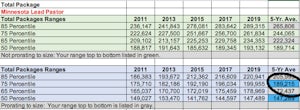

- Using Ministry Pay, here’s a sample of a church in the upper Midwest where I ran the numbers for them; church of 1700 in a city. These were the results of the participants in this survey that came close to matching those parameters.

Compensation Handbook for Church Staff

- Compensation Handbook for Church Staff is another outstanding tool I’ve used for years. Again, the church board would set criteria that is specific to their church in order to come to a conclusion of where the pastor should be paid. The 2018 book is currently sold out, but 2019 and 2020 research should be available soon.

https://store.churchlawandtax.com/2018-compensation-handbookfor-church-staff-compensation-reports-now-available-at-churchsalary-com/ - Using the same parameters these are the 5-year average results from the Compensation Handbook for Church Staff.

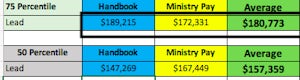

- When putting both sets of results together, this is the compilation which gives you the range from 50 percentile to 75 percentile.

In this calculation, the church should shoot for a total package compensation of $180,773 but would operate with a range of $157,359 – $180,773.

A couple things…

There are couple of things to be cautious of when using these kinds of resources. The church almost always has to create broad ranges in the categories of attendance, budget, etc. in order to obtain a large enough sampling to be confident of hitting the mark.

In other words, if the church average attendance is 750, you’ll probably have to include ranges of 500, 750 and 1000 in order to hit the mark. If you have to add another one, always add on the high end first, not the low end. Add 1250 before you add 250.

Then go back and forth until you feel you have a large enough sampling. I’ve found in most cases I end up adding both of them to get the sufficient sampling size.

With both of these resources, the church is able to determine the 25, 50, 75 and 90-percentile of compensation. Then go to work to create the range within which you can pay your pastor.

The wise and discerning church board will do all it can to create as tight a range as possible to dial in where their pastor should be paid. In other words, in an example where the pastor should be paid $100,000, you want a range of $90,000 – $110,000, not a range of $50,000 to $150,000. You’ll find the tighter you can keep the range, the closer to a correct number will be paid to your pastor.

In all cases, I implore church boards to error on the high side. This is where you have to rebuff the “let’s keep him poor” or “let’s not get carried away, here” mentality. Operate with a mentality of “how can we pay our pastor as high as possible, demonstrating over-the-top generosity.”

(NOTE: Want to know the proper roles and responsibilities for Church Boards? Click here)

The “Right” Salary

I am pleased to note that I regularly work with church boards that really want to do this right. They are intent on really finding the right salary and associated benefits for their pastor.

In doing their research, there are two comparisons of the “Right” salary.

- What is it that pastors nationally, regionally, etc. are paid?

- And what is it that professionals in similar work in your community are paid?

Comparison One

I covered the first set of comparisons above, in talking about Ministry Pay and the Compensation Handbook. It is worthwhile mentioning again, though, that I recommend targeting the 75-percentile. Lots of times a church finds itself behind that number. In that case, don’t worry. You just may have to work toward it.

If you are behind the 8-ball on this issue, here is how to do catch up. Again, let’s use our illustration of the 75-percentile point being $100,000. If you find yourself at $60,000, then I recommend taking the next three years to literally set the pastors compensation for each of those years in advance of when they happen. Yes, you can do that.

This might be new for you but literally, if the year is 2019, you can create a chart that sets the pastor’s salary for 2020, 2021 and 2022 right now.

In this scenario, with the pastor at $60,000 in 2019, I would set the pastor at $75,000 in 2020, $90,000 in 2021 and $105,000 in 2022. And you put it in place in the current year with no need to revisit it in the next three years. Just instruct the bookkeeper/treasurer of the decision of the board.

By the way, the 2022 amount allows for inflation which will have moved the $100,000 figure higher over three years.

Comparison Two

The second comparisons made are local to your community. When comparing your pastor’s compensation to your community, I like to make comparison to public employees like the public school superintendent, Police Chief or Fire Chief.

These are public employees. Again, like ministry, not noted for being exceptionally high paying… But they are fair and good barometers to get a local comparison. Because they are public employees, their full compensation is available in City government and School Board minutes, which are open to the public.

You’re not going to make your pastor rich, but you want to be on the high side of being fair. I know that’s subjective but that’s where you want to be.

Housing Allowance

Now, let’s take some time to talk about how taxes and housing allowance really work. In the U.S., pastors are normally considered employees for federal tax purposes, but self-employed for social security purposes.

Normally, pastors receive a w-2 at year end, even though there may not be amounts shown in the federal w/h, state w/h, social security and Medicare boxes. Be sure to seek with your own legal counsel and accountant on this topic. Also, go to https://www.churchlawandtax.com/ for more information on this subject.

As a church board, you need to approve the request of the pastor for their housing allowance allocation prior to the year it is paid. The pastor needs to submit in writing their request for housing allowance.

I find it best to approve housing allowance in November for the coming year, if you are operating on a calendar year.

For the church board’s information, housing allowance is a wonderful blessing of the U.S. federal tax system whereby, amounts spent on housing for a pastor are exempt from federal income tax. They are, however, taxed for social security and Medicare purposes.

This provision of the IRS is to balance against a pastor who lives in a church-owned parsonage.

The housing allowance must be the smallest of the following and should be done in advance of paying the housing allowance:

- The amount actually used to provide a home, or

- The amount officially designated as housing allowance, or

- The fair rental value of the home, including furnishings, utilities, garage, etc.

I recommend the church board set the pastor’s housing allowance on the high side in order for the pastor’s actual expenses to not exceed the housing allowance, in which case they would forfeit the housing allowance tax benefit on that portion higher than the board allocation.

Should the pastor’s actual expenses be lower than the amount allocated by the church board for housing, then the difference of the actual and the housing allocation is moved over to ordinary income for the pastor when they do their personal taxes. You want this to happen every year to maximize this benefit.

Benefits

After salary and housing allowance are provided for, what benefits are appropriate?

Health Insurance

The first benefit that should be a staple for the church in taking care of their staff is that of providing health insurance. Yes, I know it is a highticket item but build it into your budget alongside the salary.

Get creative with this benefit. Certainly, the traditional group health insurance options are out there. There are also options to do health sharing plans like Medi-Share, Liberty Health Share, etc. These are clearly worth considering for cost savings to the church and the pastor.

Retirement

The second benefit I recommend is that of retirement. Believe me, if you take care of this when a pastor is in their 30s and 40s, you won’t find yourself stuck with an aging pastor you can’t get out the door when they hit their 60s and 70s.

The number one reason pastors don’t leave to retirement when they should, is they can’t afford to do so. It is the board’s responsibility to make sure the church is not stuck in this way.

I recommend starting by creating a 5%/5% matching fund retirement plan for your pastor. This is the minimal start point. Whenever possible put the money in an after-tax retirement account. (Note, I am not a financial advisor so seek financial and legal counsel on this issue.)

In this recommendation it means if the pastor will put in 5% of their salary to retirement, then the church board will match it with the church’s funds at 5%.

If the church board is not currently doing this, then to start would mean you would need to increase your pastor’s compensation by 5% so they would have that 5% amount to contribute back to the retirement account.

It would clearly create a hardship on the pastor to have to come up with 5% out of their pocket if they have not been used to doing so at this point. So, do this add-on once and you’ll be good to go.

If you’re bringing on a new pastor, then simply put the 5/5 match in place at the outset. Then I recommend building in an acceleration of this match all the way to a 10/10 match. Maybe use the first five years of their ministry with you to increase 1% per year i.e. 5/5 in year one, 6/6 in year two, 7/7 in year three, etc.

This may seem like a lot, but you’ll really be unbelievably glad you did this when your pastor starts nearing the end of their ministry.

Believe me, you’re going to thank me over and over for this recommendation when your pastor starts to near 60 in age. You’ll be able to move them out the door without feeling like you’re kicking Grandpa to the curb!

Vacation and sick leave

The third benefit a church board should provide is annual vacation and sick leave.

I recommend starting a new pastor at three weeks’ vacation per year unless they already have more vacation from their previous church. In that case, go with the larger of the two vacation amounts.

Put in a clear statement of sick leave. Some churches will allow something like 6 or 8 days per year. Others will simply say, “If you’re sick, stay home.”

Be sure Sundays are clearly defined in vacation and sick leave. In other words, if you provide for three weeks’ vacation does that mean three Sundays, two Sundays or four Sundays. I recommend three weeks of vacation includes three Sundays.

Also, be sure it is clear that vacation is vacation, not outside ministry. The church board wants their pastor to be in demand to do outside ministry. Therefore, they need to have a provision for the pastor to do so without any infringement on personal vacation time.

Life Insurance

When possible, it is advisable to get a key man life insurance policy on the pastor. This policy would pay out in event of the death of the pastor to the church and the pastor’s spouse in some proportion.

You want the church covered because of the potential loss in income with the departure from death of the senior leader of the church. You want the pastor’s spouse covered in the event of the pastor’s death because the membership of the church will be expecting the church board to take care of the grieving spouse.

Therefore, just be smart and plan ahead for that which none of us want to have happen.

Are Bonuses Legal?

Here’s another question that comes up frequently, “Are Bonuses Legal?”

The answer is that bonuses for pastors are perfectly legal and legitimate to use as compensation thank you’s and/or motivators.

Sometimes a church wants to bless their pastor for something special or as a reward or thank for having walked through a particularly challenging time, such as a major building project. Bonuses are a great way to do this.

Another way bonuses really work well is when the compensation of a pastor moves to the higher end of the compensation range of other pastors. In this case, doing bonuses can be useful. Bonuses put money in the pastor’s pocket but don’t increase the base of compensation.

For example if you find the pastor is getting up into the 90-100 percentile of pastors’ compensation, to be able to do a year-end bonus that may be equal to what a raise would have been is good for the pastor, the church board and the church, but it doesn’t obligate the church for more in years to come.

What about “Pastor Appreciation Month” and/or birthdays, anniversaries, and more?

I encourage the church to be thoughtful in taking care of a pastor and their family during special times of the year. I don’t necessarily suggest that you have to do this publicly every time you turn around. But it is important to take care of these special times.

I recommend that things like nice gift cards for birthdays and anniversaries be given more privately to the pastor and their family. But, somebody at the church board level needs to be charged with remembering this.

Whatever you do, don’t start into some commitment of regularity if you don’t have a way to follow through with that regularity.

October is normally considered Pastor Appreciation Month at least in the U.S., so someone really needs to pay attention to this.

It’s nice to make the church aware of this for them to give the pastor notes of thanks for their service. The church board needs to initiate this.

In short, the dollar amounts in these areas can be nice but need not necessarily be overwhelming. This is an area where the thought is truly what counts.

So, at the end of the day, church board, take extra special care to take great care of your pastor in their salary and benefits. You will be unbelievable glad you did!

(NOTE: Want to know the proper roles and responsibilities for Church Boards? Click here)

So, what’s our takeaway from all of this?

It is a primary role of the church board to provide for the temporal needs of the pastor. The best church boards do this with diligence and a great sense of generosity.

I hope you’ve found this blog helpful in setting the compensation for your pastor. It is, frankly, a great privilege to be the Lord’s instrument in caring for the financial needs of the servant of the Lord to your church, called your pastor.

Always remember, compensation reviews always come around. So, just because you really did it well last year, you still need to keep coming back year after year to revisit it. This comes with the territory of board leadership.

Note: Your church would be a pretty unusual church if you had all the money in the world and could keep throwing bunches of it at your pastor. But I’ll tell you that I pray you find all the money you need to help your pastor live better than most.

Again, as I stated earlier, the way you treat your pastor in this arena of compensation, will in large part determine how the Lord responds to the financial and temporal needs of the church itself.

Generosity begets generosity!

Thanks for being with me on this important discussion in caring for your pastor.

Looking for other helpful blogs on the pastor and church boards?

Church Government: Democracy or Theocracy

How Self-Policing Can Help a Negative Church Board Member Become Positive

Church Board Members Disagreeing without Drawing Blood

10 Steps to Navigating Change with Your Church Board

How to Equip Church Board Members

Top 3 Responsibilities of Every Church Board

The 5 Investments a Church Board Needs to Make in Their Pastor

7 Essential Purposes of the Church Board

Why Invest in the Church Board?

Like this post? Sign up for our free blog updates to never miss a post. We’ll send you a FREE ebook to say “Thank You.”

Discover what pastors of growing churches do to see massive growth and how you can position your church for the greatest days ahead.

Click here to get immediate access to this free masterclass.

an-Use-to-Grow-the-Church-1000×500.jpg?auto=compress%2Cformat&fit=scale&h=150&ixlib=php-3.3.1&q=60&w=300&wpsize=medium&s=19bc22ff6370a69e8b08c8ca4e7147d7 300w, https://leaders-church.imgix.net/2020/05/4-Secrets-Pastors-Can-Use-to-Grow-the-Church-1000×500.jpg?auto=compress%2Cformat&fit=scale&h=305&ixlib=php-3.3.1&q=60&w=610&wpsize=infusionsoft_image&s=60bcf7141c3f3fd9b1bd9351ebed29b4 610w, https://leaders-church.imgix.net/2020/05/4-Secrets-Pastors-Can-Use-to-Grow-the-Church-1000×500.jpg?auto=compress%2Cformat&fit=scale&h=384&ixlib=php-3.3.1&q=60&w=768&wpsize=medium_large&s=6825ae91cfc513e854fbc9683cb49263 768w, https://leaders-church.imgix.net/2020/05/4-Secrets-Pastors-Can-Use-to-Grow-the-Church-1000×500.jpg?auto=compress%2Cformat&ixlib=php-3.3.1&q=60&s=7a3414e460a607b2733caeb1e5b399df 1000w” alt=”Church Growth Masterclass for Pastors” width=”1000″ height=”500″ />